TERMS OF USE ︳ PRIVACY POLICY ︳ DISCLOSURE

on the

HORIZON

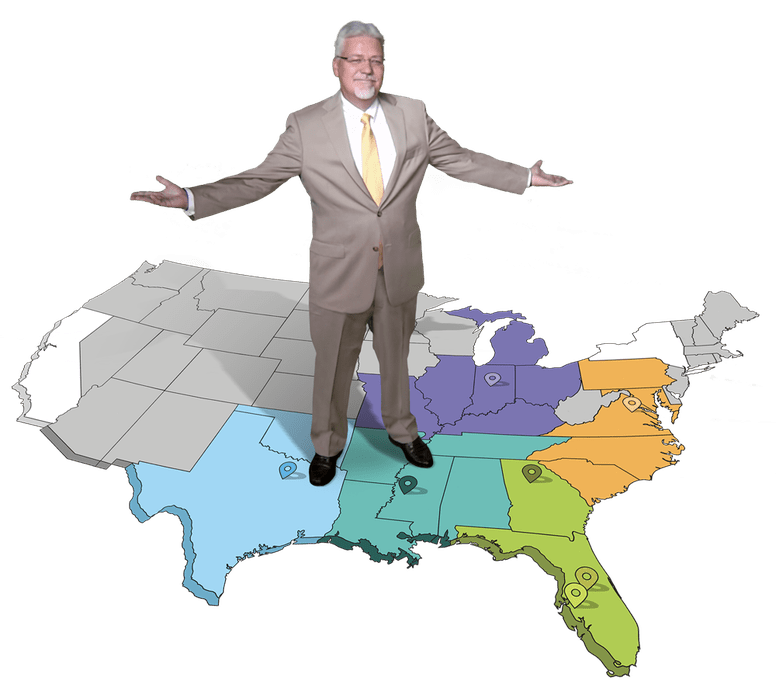

The continued expansion of FCCI’s Surety Team

When it comes to underwriting risk with surety bonds in 2023, FCCI is focusing on something it does well in the industry — recruiting the right teammates, especially in the places where they’re needed most.

This is a strategy that makes perfect sense for Surety, considering that after several years of significant growth, the department is closer than ever to achieving its longtime goal of expanding the Surety team nationwide.

“We expect to be in 46 states by the end of 2023,” says Scott Paice. “To do that, we have to hire the right people that can build those relationships or already have relationships in place. We’ll be introducing FCCI’s Surety to states that don’t know us yet. We're working to bring in the right teammates to nurture those locations.”

Scott is the Senior Vice President of Surety and has been with FCCI since 2010. At that time, the company held only a small book of commercial bond business in Mississippi. But on January 1, 2011, it expanded into Contract Surety and all of the existing FCCI operating states, and has continued to grow ever since.

“2022 was our best year yet, as we rounded $35 million, and ended up growing 28%,” says Scott.

“Our goal for 2023 is 10% growth, mainly because we're expecting a slowdown from the economy because of rising interest rates. You’re not going to see as many new buildings going up, although there is a lot of federal money coming out, we're not sure how much may trickle down to our size of accounts. I am expecting things to slow a bit this year.”

A contract surety bond guarantees to the owner of a construction project that the contractor will perform the work specified by the contract and pay its subs and suppliers. This accounts for roughly 90 to 95% of what FCCI’s team handles, with the remainder in commercial.

Contractors are required to post surety bonds on all federal or state projects, and for most local public projects as well. They often tend to travel to wherever the work needs to be done. According to Scott, that’s probably the biggest reason why FCCI is getting into more states with surety — it’s important to be available where needed.

“It kind of feels like we’re starting another phase, which is very exciting,” he enthuses. “It’s invigorating to be expanding so much, at least geographically. Again, on the premium side and it’s going to take time to build those relationships in the new states. But just the thought of FCCI going from 20 states to 46 states is really something to be proud of. We currently don't have plans to go into New York, California, Alaska and Hawaii.”

To get to this point, FCCI has had to get the licensing, rates and technology all worked out in advance. But being this close to completion means that Scott is now bringing in new teammates to those new relationships.

“Talent acquisition,” he nods. “That’s a key part of my job at the moment. Just trying to get the right teammates in place to be able to build the business. It all starts with people.”

“Everybody charges pretty much the same rates in the surety business. It’s more about the selection process, the underwriting appetite, things like that. But the secret with FCCI is that we’ve always been a great business that has built its success on relationships.”

“In these new states where they don’t know us yet, we’ll have to prove ourselves by servicing the heck out of everything and being totally responsive, like we currently do in our existing states,” Scott emphasizes. “We’ll work harder than anyone else to meet people, build trust and stay visible. But fortunately, those are the things that FCCI is known for doing anyway.”